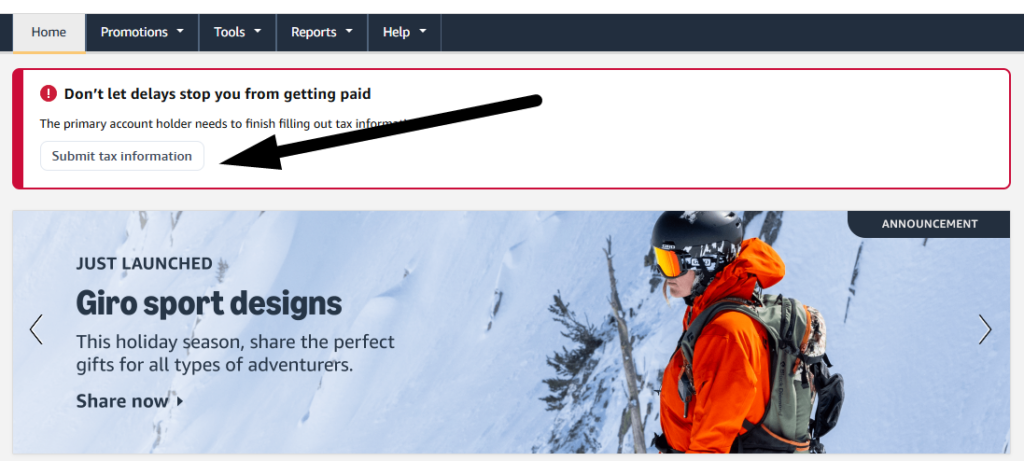

Step 1: Log in to Your Amazon Associates Account

- To get started with how to set up tax information on Amazon Associates, go to the Amazon Associates homepage.

- Log in with your Amazon account credentials.

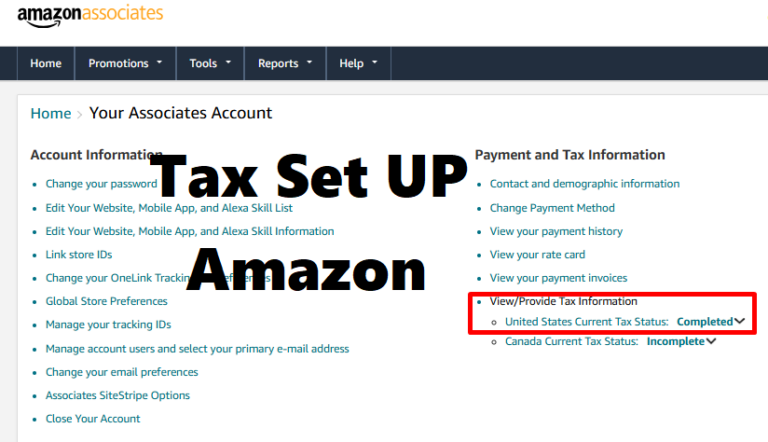

Step 2: Navigate to the Tax Information Section

- After logging in, go to the “Account Settings” or “Payment and Tax Information” section.

- Click on “Manage Your Tax Information” to begin the setup process.

Step 3: Begin the Tax Interview

- Amazon uses an online Tax Interview Tool to collect your tax information.

- Click “Start Tax Interview” to begin.

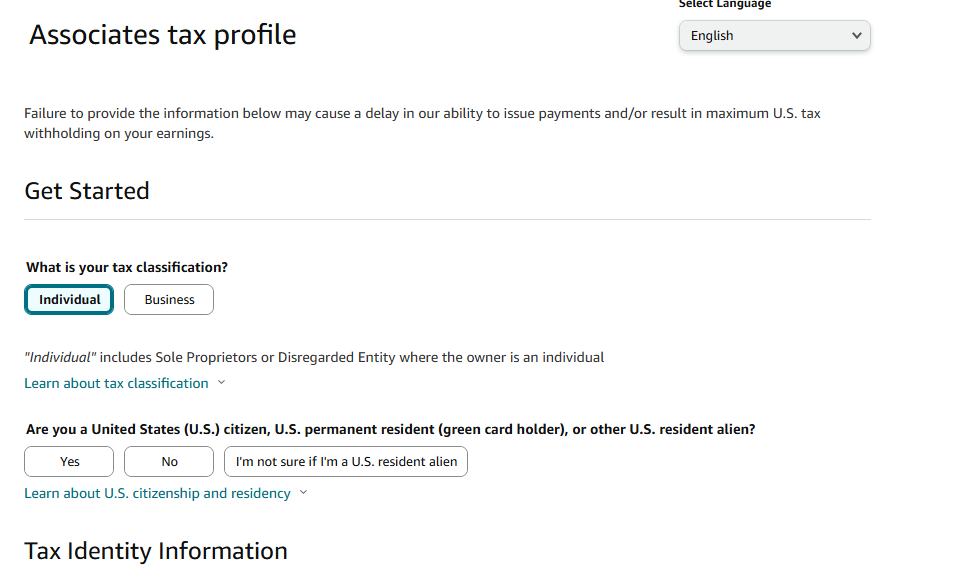

Step 4: Provide Personal or Business Details

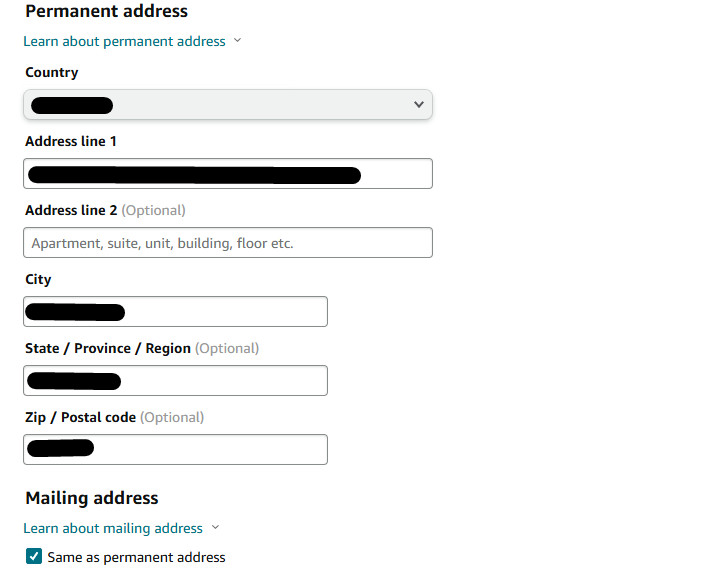

- Choose whether you are submitting as an individual or a business.

- Enter your name or business name, and provide your address.

- Ensure this matches your official tax documentation.

Step 5: Select Your Tax Classification

- Choose your tax classification:

- U.S. Person (Citizen/Resident): Select if you’re a U.S. citizen, resident alien, or entity based in the United States.

- Non-U.S. Person: Select if you are based outside the U.S.

Step 6: Complete the Relevant Tax Form

- For U.S. Persons:

- Fill out Form W-9:

- Name

- Social Security Number (SSN) or Employer Identification Number (EIN)

- Address

- Confirm that you’re a U.S. taxpayer. (Note: if you are in the U.S. and have all the documents above use (1)

- Fill out Form W-9:

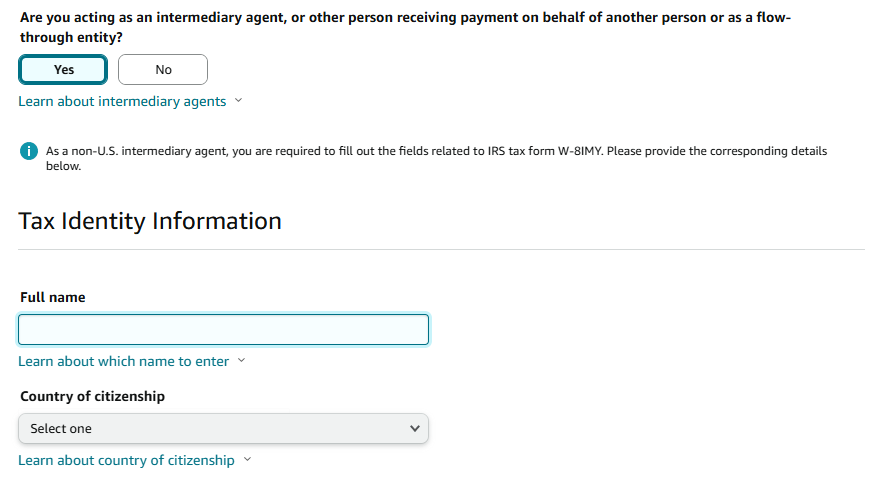

- For Non-U.S. Persons:

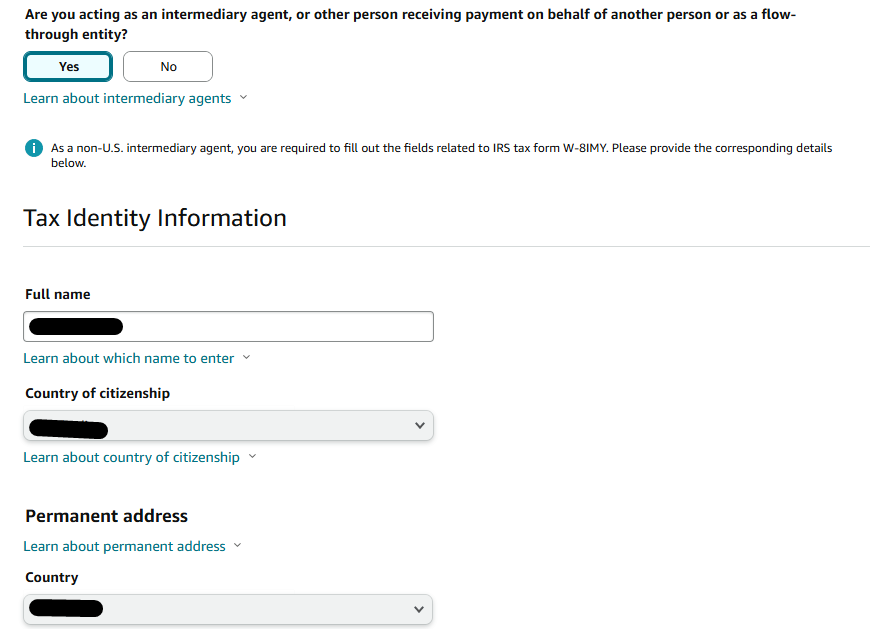

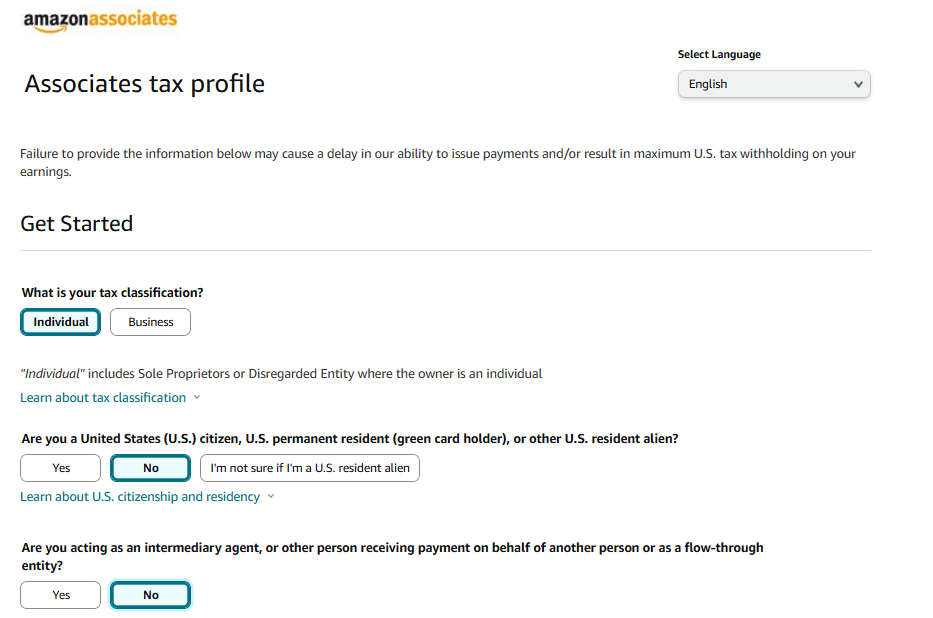

- Fill out Form W-8BEN (for individuals) or W-8BEN-E (for entities):

- Country of residence

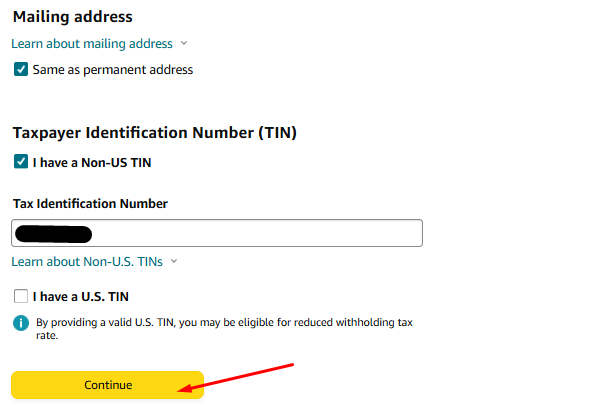

- Foreign tax identification number (TIN) or U.S. TIN (if applicable)

- Address

- Treaty benefits (if your country has a tax treaty with the U.S., reducing withholding taxes).

- Fill out Form W-8BEN (for individuals) or W-8BEN-E (for entities):

Here If you not living in the U.S you should select No, if you living in the U.S, select Yes

At Tax Identification Number you can enter your ID Card of your country, then continue…

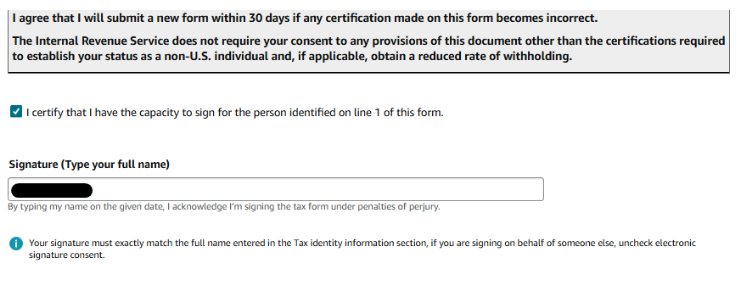

Step 7: Review and Confirm

- Verify the information you entered for accuracy.

- Electronically sign the form by typing your name in the signature box.

Step 8: Submit the Tax Form

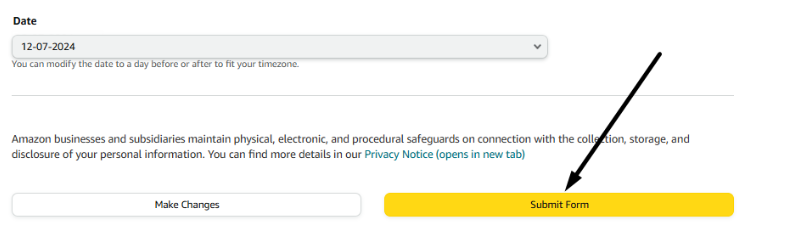

- Click “Submit Form” once all the information is filled out.

- Amazon will notify you if the form is successfully submitted or if there are errors that need correction.

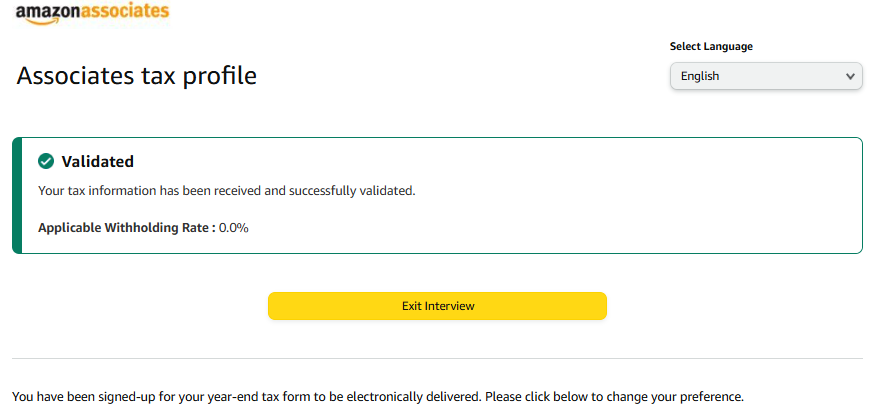

Step 9: Check the Tax Form Status

- Return to the Tax Information section to confirm the form status.

- If accepted, the status will show as “Validated” or equivalent.

Now you are done with the Tax filling form, next have to Set up Payments

Step 10: Update if Necessary

- Update your tax information if your circumstances change (e.g., address, tax residency, or legal status).

- Revisit the Tax Information section to make updates. Currently, you can update your Tax Information if you see it is wrong.

Additional Tips

- Tax Treaty Benefits: If your country has a tax treaty with the U.S., ensure you complete the necessary section in Form W-8BEN to reduce or eliminate U.S. withholding tax (the standard rate is 30% without a treaty).

- Keep Copies: Save a copy of your submitted tax form for your records.

- Seek Professional Help: If unsure, consult a tax professional to ensure compliance with U.S. and international tax laws.

By completing these steps, you’ll have your tax information set up on Amazon Associates, allowing you to receive payments smoothly.